A lot’s happened since the last Leaside Stock Index report in the March issue of the paper so let’s get you up to speed on all the developments.

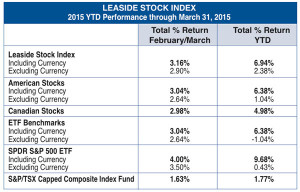

The LSI finished the first quarter of 2015 in pretty good shape, up 6.9 percent year-to-date including currency, up 2.4 percent without it. Year-to-date currency’s been a big part of the LSI’s performance.

Generally, stocks were fairly sluggish in the first part of the year but since then have shaken off some of the rust with the index’s two benchmark ETFs — SPDR S&P 500 ETF and S&P/TSX Capped Composite Index Fund — up 3.5 percent (excluding currency) and 1.6 percent respectively in the two-month period of February and March.

On the news front the biggest happening affecting the LSI is that PetSmart is no longer part of the portfolio. Its sale to BC Partners, a European private equity firm, was completed on March 11 at a price of $83 per share, providing the LSI with a total annualized return of 19.7 percent.

The proceeds from the PetSmart sale must now be reinvested in another U.S.-listed stock that benefits from the Leaside community. One possibility is Whole Foods, who are scheduled to open a store at Bayview and Broadway later in 2015. For now the cash will remain on the sidelines. Feel free to email the editor with any suggestions.

Three stocks have delivered double-digit returns so far in 2015: Dollarama up 19.4 percent; Starbucks up 15.4 percent and Dunkin’ Brands (Baskin Robbins) up 11 percent. It seems you can’t go wrong with coffee and discount merchandise.

Speaking of Starbucks, it announced in March that it was splitting its stock two-for-one on April 8, meaning the LSI will now own twice as many shares in the coffee chain.

The fourth-best performing stock year-to-date is a rather controversial one. In January RioCan announced it was redeveloping Sunnybrook Plaza. Despite some local opposition the news seems to have helped its stock, which is up almost 10 percent year-to-date. Other than Dollarama no Canadian stock has done better in 2015.

What’s weighing down the LSI?

When it comes to Canadian stocks nothing stands out as a real dog with the two worst performers being banks. TD and Bank of Nova Scotia down 2.4 percent and 4.3 percent respectively year-to-date. Unless things change with the Canadian economy you can expect these two stocks to remain in the doldrums. Otherwise things are looking good on the Canadian side of the equation.

The biggest disappointment from American stocks is Vitamin Shoppe (owners of Vitapath in Leaside Village), down 15.2 percent year-to-date and 28 percent since the LSI’s inception in February 2014. Recent reports say the company might sell some weight-loss products that contain a substance similar to amphetamines. Continue to expect a bumpy ride on its stock.

Down one stock with the loss of PetSmart, the U.S. portion of the portfolio isn’t going to be nearly as productive in the second quarter as it’s been in the past year.